Factors which influence the exchange rate:

Exchange rates are determined by factors, such as interest rates, confidence, current account on balance of payments, economic growth and relative inflation rates. For example:

- If US business became relatively more competitive, there would be greater demand for American goods; this increase in demand for US goods would cause an appreciation (increase in value) of the dollar.

- However, if markets were worried about the future of the US economy, they would tend to sell dollars, leading to a fall in the value of the dollar.

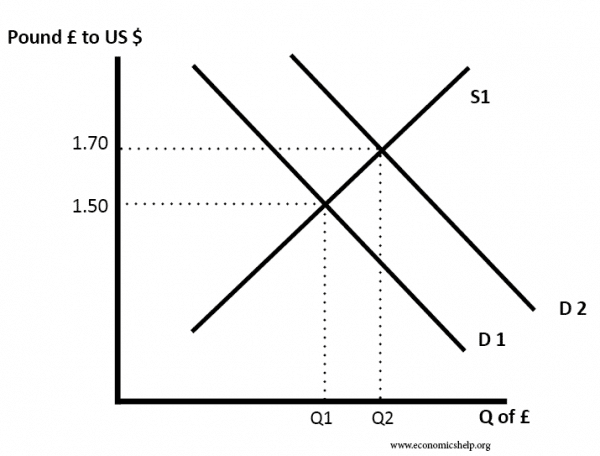

Determination of exchange rates using supply and demand diagram

In this example, a rise in demand for Pound Sterling has led to an increase in the value of the £ to $ – from £1 = $1.50 to £1 = $1.70

Note:

- Appreciation = increase in value of exchange rate

- Depreciation / devaluation = decrease in value of exchange rate.

Factors that influence exchange rates

1. Inflation

If inflation in the UK is relatively lower than elsewhere, then UK exports will become more competitive and there will be an increase in demand for Pound Sterling to buy UK goods. Also foreign goods will be less competitive and so UK citizens will buy less imports.

- Therefore countries with lower inflation rates tend to see an appreciation in the value of their currency. For example, the long term appreciation in the German D-Mark in post-war period was related to the relatively lower inflation rate.

2. Interest rates

If UK interest rates rise relative to elsewhere, it will become more attractive to deposit money in the UK. You will get a better rate of return from saving in UK banks, Therefore demand for Sterling will rise. This is known as “hot money flows” and is an important short run factor in determining the value of a currency.

- Higher interest rates cause an appreciation.

- Cutting interest rates tends to cause a depreciation

3. Speculation

If speculators believe the sterling will rise in the future, they will demand more now to be able to make a profit. This increase in demand will cause the value to rise. Therefore movements in the exchange rate do not always reflect economic fundamentals, but are often driven by the sentiments of the financial markets. For example, if markets see news which makes an interest rate increase more likely, the value of the pound will probably rise in anticipation.

The fall in the value of the Pound post-Brexit was partly related to the concerns that UK would no longer attract as many capital flows outside the Single Currency.

4. Change in competitiveness

If British goods become more attractive and competitive this will also cause the value of the exchange rate to rise. For example, if the UK has long-term improvements in labour market relations and higher productivity, good will become more internationally competitive and in long-run cause an appreciation in the Pound. This is a similar factor to low inflation.

5. Relative strength of other currencies

In 2010 and 2011, the value of the Japanese Yen and Swiss Franc rose because markets were worried about all the other major economies – US and EU. Therefore, despite low interest rates and low growth in Japan, the Yen kept appreciating. In the mid 1980s, the Pound fell to a low against the Dollar – this was mostly due to strength of Dollar, caused by rising interest rates in the US.

6. Balance of payments

A deficit on the current account means that the value of imports (of goods and services) is greater than the value of exports. If this is financed by a surplus on the financial / capital account then this is OK. But a country who struggles to attract enough capital inflows to finance a current account deficit, will see a depreciation in the currency. (For example current account deficit in US of 7% of GDP was one reason for depreciation of dollar in 2006-07). In the above diagram, the UK current account deficit reached 7% of GDP at the end of 2015, contributing to the decline in the value of the Pound.

7. Government debt

Under some circumstances, the value of government debt can influence the exchange rate. If markets fear a government may default on its debt, then investors will sell their bonds causing a fall in the value of the exchange rate. For example, Iceland debt problems in 2008, caused a rapid fall in the value of the Icelandic currency.

For example, if markets feared the US would default on its debt, foreign investors would sell their holdings of US bonds. This would cause a fall in the value of the dollar. See: US dollar and debt

8. Government intervention

Some governments attempt to influence the value of their currency. For example, China has sought to keep its currency undervalued to make Chinese exports more competitive. They can do this by buying US dollar assets which increases the value of the US dollar to Chinese Yuan.

- see also: Chinese Currency | Swiss Franc pegged against Euro

9. Economic growth / recession

A recession may cause a depreciation in the exchange rate because during a recession interest rates usually fall. However, there is no hard and fast rule. It depends on several factors. See: Impact of recession on currency.

Example fall in value of Sterling 2007 – Jan 2009

During this period 2007-09, the value of Sterling fell over 20%. This was due to:

- Restoring UK’s lost competitiveness. UK had large current account deficit in 2007

- Bank of England cut interest rates to 0.5% in 2008.

- Recession hit UK economy hard. Markets expected interest rates in UK to stay low for a considerable time.

- Bank of England pursued quantitative easing (increasing money supply). This raised prospect of future inflation, making UK bonds less attractive.

8 Key Factors that Affect Foreign Exchange Rates:

Foreign Exchange rate (ForEx rate) is one of the most important means through which a country’s relative level of economic health is determined. A country’s foreign exchange rate provides a window to its economic stability, which is why it is constantly watched and analyzed. If you are thinking of sending or receiving money from overseas, you need to keep a keen eye on the currency exchange rates.

The exchange rate is defined as “the rate at which one country’s currency may be converted into another.” It may fluctuate daily with the changing market forces of supply and demand of currencies from one country to another. For these reasons; when sending or receiving money internationally, it is important to understand what determines exchange rates.

This article examines some of the leading factors that influence the variations and fluctuations in exchange rates and explains the reasons behind their volatility, helping you learn the best time to send money abroad.

1. Inflation Rates

Changes in market inflation cause changes in currency exchange rates. A country with a lower inflation rate than another’s will see an appreciation in the value of its currency. The prices of goods and services increase at a slower rate where the inflation is low. A country with a consistently lower inflation rate exhibits a rising currency value while a country with higher inflation typically sees depreciation in its currency and is usually accompanied by higher interest rates

2. Interest Rates

Changes in interest rate affect currency value and dollar exchange rate. Forex rates, interest rates, and inflation are all correlated. Increases in interest rates cause a country’s currency to appreciate because higher interest rates provide higher rates to lenders, thereby attracting more foreign capital, which causes a rise in exchange rates

3. Country’s Current Account / Balance of Payments

A country’s current account reflects balance of trade and earnings on foreign investment. It consists of total number of transactions including its exports, imports, debt, etc. A deficit in current account due to spending more of its currency on importing products than it is earning through sale of exports causes depreciation. Balance of payments fluctuates exchange rate of its domestic currency.

4. Government Debt

Government debt is public debt or national debt owned by the central government. A country with government debt is less likely to acquire foreign capital, leading to inflation. Foreign investors will sell their bonds in the open market if the market predicts government debt within a certain country. As a result, a decrease in the value of its exchange rate will follow.

5. Terms of Trade

Related to current accounts and balance of payments, the terms of trade is the ratio of export prices to import prices. A country’s terms of trade improves if its exports prices rise at a greater rate than its imports prices. This results in higher revenue, which causes a higher demand for the country’s currency and an increase in its currency’s value. This results in an appreciation of exchange rate.

6. Political Stability & Performance

A country’s political state and economic performance can affect its currency strength. A country with less risk for political turmoil is more attractive to foreign investors, as a result, drawing investment away from other countries with more political and economic stability. Increase in foreign capital, in turn, leads to an appreciation in the value of its domestic currency. A country with sound financial and trade policy does not give any room for uncertainty in value of its currency. But, a country prone to political confusions may see a depreciation in exchange rates.

7. Recession

When a country experiences a recession, its interest rates are likely to fall, decreasing its chances to acquire foreign capital. As a result, its currency weakens in comparison to that of other countries, therefore lowering the exchange rate.

8. Speculation

If a country’s currency value is expected to rise, investors will demand more of that currency in order to make a profit in the near future. As a result, the value of the currency will rise due to the increase in demand. With this increase in currency value comes a rise in the exchange rate as well.

Conclusion:

All of these factors determine the foreign exchange rate fluctuations. If you send or receive money frequently, being up-to-date on these factors will help you better evaluate the optimal time for international money transfer. To avoid any potential falls in currency exchange rates, opt for a locked-in exchange rate service, which will guarantee that your currency is exchanged at the same rate despite any factors that influence an unfavorable fluctuation.