Interest:

Interest is payment from a borrower or deposit-taking financial institution to a lender or depositor of an amount above repayment of the principal sum (i.e. the amount borrowed). It is distinct from a fee which the borrower may pay the lender or some third party.

For example, a customer would usually pay interest to borrow from a bank, so they pay the bank an amount which is more than the amount they borrowed; or a customer may earn interest on their savings, and so they may withdraw more than they originally deposited. In the case of savings, the customer is the lender, and the bank plays the role of the borrower.

Interest differs from profit, in that interest is received by a lender, whereas profit is received by the owner of an asset, investment or enterprise. (Interest may be part or the whole of the profit on an investment, but the two concepts are distinct from one another from an accounting perspective.)

The rate of interest is equal to the interest amount paid or received over a particular period divided by the principal sum borrowed or lent.

Compound interest means that interest is earned on prior interest in addition to the principal. Due to compounding, the total amount of debt grows exponentially, and its mathematical study led to the discovery of the number . In practice, interest is most often calculated on a daily, monthly, or yearly basis, and its impact is influenced greatly by its compounding rate.

Q: How do interest rates affect exchange rates?

A: Interest rates influence exchange rates because they directly affect the supply and demand of a nation’s currency. Fluctuating interest rates affect currency values in a directly proportionate manner. Higher interest rates provide lenders a higher return relative to other nations; higher returns attract foreign capital, which increases demand and causes the exchange rate to rise. The opposite is true for decreasing interest rates, which proportionately decreases exchange rates.

A country’s central bank exerts influence over exchange rates by setting interest rates and subsequently controlling monetary policy. The primary influence that drives exchange rates is interest-rate changes made by any of the eight global central banks. These banks increase interest rates to curb inflation and cut rates to promote lending and inject money into their economies.

Unexpected increases in the interest rate in the United States relative to overseas would provide investors a higher return on U.S. assets relative to their foreign equivalents. This raises the value of the dollar, reduces the price of imports and reduces demand of U.S. goods and services abroad.

Exchange rates are relative because they are a comparison of the currencies of two countries. Several factors determine exchange rates, but all are related to the economies and trading relationship between the two countries. Interest rates provide a scale for the cost of borrowing or the gain from lending.

How do changes in national interest rates affect a currency’s value and exchange rate?

Generally, higher interest rates increase the value of a given country’s currency. The higher interest rates that can be earned tend to attract foreign investment, increasing the demand for and value of the home country’s currency. Conversely, lower interest rates tend to be unattractive for foreign investment and decrease the currency’s relative value.

However, this simple equation is complicated by a host of other factors that impact currency value and exchange rates. One of the primary complicating factors is the interrelationship that exists between higher interest rates and inflation. If a country can manage to achieve a successful balance of increased interest rates without an accompanying increase in inflation, then the value and exchange rate for its currency is more likely to rise.

Interest rates alone do not determine the value of a currency. Two other factors that are often of greater importance are political and economic stability and the demand for a country’s goods and services. Factors such as a country’s balance of trade between imports and exports can be a much more crucial determining factor for currency value. Greater demand for a country’s products means greater demand for the country’s currency as well. Favorable gross domestic product (GDP)and balance of trade numbers are key figures that analysts and investors consider in assessing the desirability of owning a given currency.

Another important factor is a country’s level of debt. While they can be managed for some period of time, high levels of debt eventually lead to higher inflation rates and may ultimately trigger an official devaluation of a country’s currency.

The recent history of the United States clearly illustrates the critical importance of a country’s overall perceived political and economic stability. In recent years, U.S. government and consumer debt has exploded to new high levels. In an attempt to stimulate the U.S. economy, the Federal Reserve has maintained interest rates near zero. Despite these facts, the U.S. dollar has enjoyed favorable exchange rates in relation to the currencies of most other nations. This is partially due to the fact that the U.S. retains, at least to some extent, the position of being the reserve currency for much of the world. Also, the U.S. dollar is still perceived as a safe haven in an economically uncertain world. This fact, more so than interest rates, inflation or other considerations, has proven to be the overriding and determining factor for the relative value of the U.S. dollar.

Effect of lower interest rates:

A look at the economic effects of a cut in the Central Bank base rate.

Summary: Lower interest rates make it cheaper to borrow. This tends to encourage spending and investment. This leads to higher aggregate demand (AD) and economic growth. This increase in AD may also cause inflationary pressures.

In theory, lower interest rates will:

- Reduce the incentive to save. Lower interest rates give a smaller return from saving. This lower incentive to save will encourage consumers to spend rather than hold onto money.

- Cheaper borrowing costs. Lower interest rates make the cost of borrowing cheaper. It will encourage consumers and firms to take out loans to finance greater spending and investment.

- Lower mortgage interest payments. A fall in interest rates will reduce the monthly cost of mortgage repayments. This will leave householders with more disposable income and should cause a rise in consumer spending.

- Rising asset prices. Lower interest rates make it more attractive to buy assets such as housing. This will cause a rise in house prices and therefore rise in wealth. Increased wealth will also encourage consumer spending as confidence will be higher. (wealth effect)

- Depreciation in the exchange rate. If the UK reduce interest rates, it makes it relatively less attractive to save money in the UK (you would get a better rate of return in another country). Therefore there will be less demand for the Pound Sterling causing a fall in its value. A fall in the exchange rate makes UK exports more competitive and imports more expensive. This also helps to increase aggregate demand.

Overall, lower interest rates should cause a rise in Aggregate Demand (AD) = C + I + G + X – M. Lower interest rates help increase (C), (I) and (X-M)

Update – cut to 0.25% post Brexit

- Will cut in interest rates to 0.25% work in Brexit Britain?

UK interest rates

UK interest rates were cut in 2009 to try and increase economic growth after the recession of 2008/09, but there effect was limited by the difficult economic circumstances and after effects of global credit crunch.

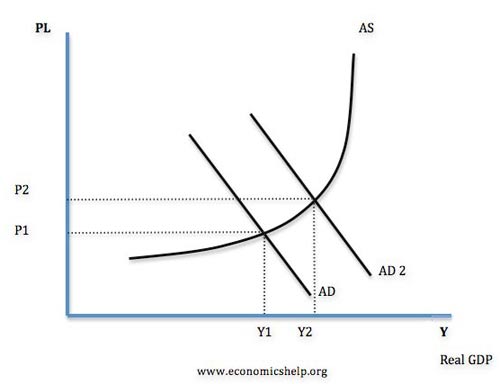

AD/AS diagram showing effect of a cut in interest rates

If lower interest rates cause a rise in AD, then it will lead to an increase in real GDP (higher rate of economic growth) and an increase in the inflation rate.

Evaluation of a cut in interest rates This shows the cut in interest rates in 2009, was only partially successful in causing higher economic growth. This is because many other factors were affecting economic growth apart from interest rates.

This shows the cut in interest rates in 2009, was only partially successful in causing higher economic growth. This is because many other factors were affecting economic growth apart from interest rates.

Evaluation points

- Will interest rate cut be passed on to consumers? If the Central Bank cut the base rate, banks may not pass this base rate cut onto consumers. For example, in the credit crunch of 2008/09, banks were short of liquidity and keen to encourage more bank deposits. Therefore, when interest rates were cut to 0.5%, banks didn’t reduce their interest rates very much so the interest rate cut had little effect on consumers.

- It depends on other factors in the economy. Ceteris paribus, a fall in in interest rates should cause higher economic growth, however there may be other factors that cause the economy to remain depressed. For example, if there is a global recession then export demand will be falling and this may outweigh the small increase in consumer spending.

- Bank Lending. Interest rates may be low, but banks may be unwilling to lend. e.g. after credit crunch of 2008, banks reduced the availability of mortgages. Therefore, even if people wanted to borrow at low interest rates they couldn’t because they needed a high deposit.

- Consumer Confidence. If interest rates are cut, people may not always want to borrow more. If confidence is low, a cut in interest rates may not encourage more spending. After 2008, we saw an increase in the savings ratio (despite interest rate cut) this was because confidence fell in the great recession.

- Deflation. If we had deflation then even if interest rates are very low, then people may still prefer to save because the effective real interest rate is still quite high.

- Time Lag. A cut in interest rates can have up to 18 months to affect the economy. For example, you may have a two year fixed mortgage deal. Therefore, you are not affected by the lower interest rate until the end of your two year fixed mortgage term.

Impact on different groups in society

A cut in interest rates will have a different impact on different groups within society.

- Lower interest rates are good news for borrowers, homeowners (mortgage holders). This group may spend more.

- Lower interest rates is bad news for savers. For example, retired people may live on their savings. If interest rates fall, they have lower disposable income and so will probably spend less.

- If a country has a high proportion of savers then lower interest rates will actually reduce the income of many people. In the UK, we tend to be a nation of borrowers and have high levels of mortgage debt, therefore cuts in interest rates have a bigger impact in the UK, than EU countries with a higher proportion of people who rent rather than buy.

Impact on current account

- On the one hand, lower interest rates encourage consumer spending; therefore there will be a rise in spending on imports. This will cause a deterioration in the current account.

- However, lower interest rates should cause a depreciation in the exchange rate. This makes exports more competitive, and if demand is relatively elastic, the impact of a lower exchange rate should cause an improvement in the current account. Therefore, it is not certain how the current account will be affected.